EMCOR (EME) Q1 Earnings Lag, Revenue Top Estimates, Stock Down

EMCOR Group, Inc.‘s EME shares fell 5.86% on Apr 28 after it reported mixed first-quarter 2022 results. The bottom line lagged the Zacks Consensus Estimate and declined on a year-over-year basis. Volatile operating environment, particularly in the U.S. Construction and U.S. Building Services segments hampered earnings due to labor disruption stemming from the Omicron variant, supply chain issues and rising energy costs.

On the contrary, revenues surpassed the Consensus Estimate and moved up from the year-ago quarter’s levels, driven by double-digit growth in the U.S. Electrical Construction, U.S. Building Services and U.S. Industrial Services segments.

Tony Guzzi, chairman, president and CEO of EMCOR, said, "Moving further into 2022, we will continue to execute with discipline and flexibility as we navigate the ongoing supply chain headwinds. While the operating environment remains volatile, we are optimistic that the non-residential construction market will continue to grow through the year and are confident in our long-term outlook as evidenced by today’s announcement that the Board has authorized a new share repurchase program.”

Earnings & Revenues Discussion

The company reported adjusted earnings of $1.39 per share, missing the consensus mark of $1.62 by 14.2% and declining 9.7% from the year-ago quarter’s figure of $1.54.

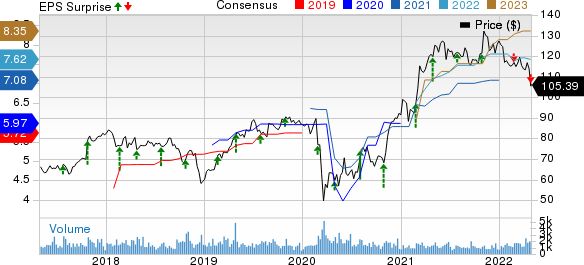

EMCOR Group, Inc. Price, Consensus and EPS Surprise

EMCOR Group, Inc. price-consensus-eps-surprise-chart | EMCOR Group, Inc. Quote

Revenues totaled $2.59 billion, surpassing the consensus mark of $2.46 billion by 5.5% and rising 12.5% year over year. Organic revenues were up 10.4%.

Segment Details

The U.S. Construction segment revenues were up 10.8% year over year to $1.52 billion. Segment operating margin fell 230 basis points (bps) year over year.

Within the U.S. Construction umbrella, the U.S. Electrical Construction and Facilities Services segment revenues increased 13.6% year over year to $522.03 million. Operating income fell 50.3% and margin contracted 500 bps year over year. The U.S. Mechanical Construction and Facilities Services segment revenues rose 9.4% from a year ago to $1,000.5 million. Its operating income declined 7.1% and its margin contracted 100 bps year over year.

Revenues in the U.S. Building Services segment rose 10.5% from the prior-year quarter’s levels to $627.8 million, driven by continued strength in the mobile mechanical services and commercial site-based services divisions. Operating income declined 23.1% year over year and margin was down 170 bps.

The U.S. Industrial Services unit’s revenues increased 32% year over year to $310.75 million. Operating income surged 642.7% and the operating margin was 4.3% against a negative 1% a year ago.

The U.K. Building Services segment’s revenues gained 3.8% from the year-ago quarter to $131.5 million on excellent contracts and specialized project execution. Operating income rose 12.5% and the operating margin rose 70 bps year over year.

Operating Highlights

Gross margins contracted 120 bps to 13.6% for the quarter. Selling, general and administrative expenses — as a percentage of revenues — of 9.7% remained stable from the prior-year quarter’s levels.

Operating income in the quarter amounted to $100 million, up 3.9% year over year. The operating margin of 3.9% contracted 120 bps from the prior-year quarter’s levels due to ongoing supply chain and COVID-related impacts.

Liquidity & Cash Flow

As of Mar 31, 2022, EME had cash and cash equivalents of $514.5 million compared with $821.3 million at 2021-end. Long-term debt and finance lease obligations totaled $245.4 million, marking a slight decline from the 2021-end level of $245.45 million.

For the first three months of 2022, net cash used in operating activities was $95.8 million compared with $89 million in the year-ago period.

The remaining performance obligations at March-end were $5.95 billion, up 24.5% from $4.78 billion at March 2021-end.

2022 Guidance Maintained

EMCOR expects earnings per share within $7.15-$7.85 and revenues between $10.4 billion and $10.7 billion. The Zacks Consensus Estimate for earnings is currently pegged at $7.62 per share. The consensus estimate for revenues is currently pegged at $10.44 billion.

Zacks Rank & Recent Construction Releases

EMCOR currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Armstrong World Industries, Inc. AWI reported unimpressive results for first-quarter 2022. The top and the bottom line missed their respective Zacks Consensus Estimate but increased on a year-over-year basis. The upside can be attributed to solid pricing actions and strong execution of growth opportunities in the Architectural Specialties segment and digital and Healthy Spaces initiatives.

Armstrong World noted that lower Mineral Fiber sales volumes and equity earnings, primarily due to reductions in distributor inventory levels, affected the results.

Masco Corporation MAS reported solid results for first-quarter 2022. The top and the bottom line surpassed the Zacks Consensus Estimate and improved on a year-over-year basis.

The upside was mainly backed by solid demand for its products and operational efficiencies.

Otis Worldwide Corporation OTIS reported strong results in first-quarter 2022. Its earnings surpassed the Zacks Consensus Estimate and rose on a year-over-year basis.

Sales also improved from the year-ago figure but marginally lagged the consensus mark.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masco Corporation (MAS) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance