Investors are selling off Ambrx Biopharma (NYSE:AMAM), lack of profits no doubt contribute to shareholders one-year loss

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But serious investors should think long and hard about avoiding extreme losses. We wouldn't blame Ambrx Biopharma Inc. (NYSE:AMAM) shareholders if they were still in shock after the stock dropped like a lead balloon, down 80% in just one year. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. Ambrx Biopharma hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 25% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 19% decline in the broader market, throughout the period.

After losing 13% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Ambrx Biopharma

Ambrx Biopharma wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Ambrx Biopharma's revenue didn't grow at all in the last year. In fact, it fell 45%. That's not what investors generally want to see. The share price fall of 80% in a year tells the story. That's a stern reminder that profitless companies need to grow the top line, at the very least. Of course, extreme share price falls can be an opportunity for those who are willing to really dig deeper to understand a high risk company like this.

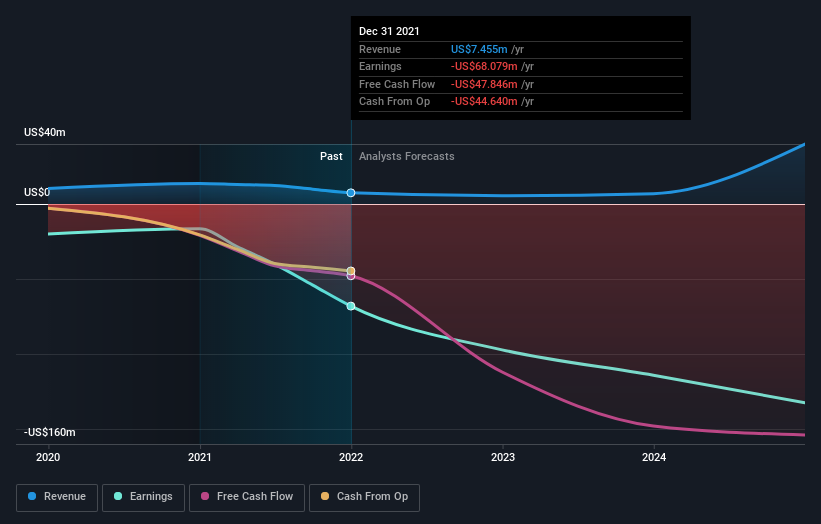

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Ambrx Biopharma shareholders are down 80% for the year, even worse than the market loss of 20%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 25% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Ambrx Biopharma you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance