Posthaste: TD beats out Royal Bank to become Canada's most valuable brand

Good morning!

Toronto-Dominion Bank has dethroned Royal Bank of Canada as the country’s top brand, according to Brand Finance PLC’s annual report on the most valuable and strongest Canadian brands.

TD’s brand value — up 27 per cent to $27.5 billion — was driven by a positive re-evaluation of its revenues and forecasts. The bank previously held the title in 2013, 2020 and 2021. RBC slipped to second spot as its brand value decreased by 15 per cent to $19.9 billion due to a dampened outlook and forecasted revenues.

The brand value gap between TD and its competitors could widen further in the coming years, the report said, as “every move TD makes matters.”

However, the recent collapse of Silicon Valley Bank has exposed the fragility of the worldwide banking system.

“Increased interconnectedness between Canadian and American banking sectors will tie the fate of the Canadian economy and banking closer to that of its American neighbours’,” the report said.

The third most valuable Canadian brand was Bank of Nova Scotia, followed by Canada Life Assurance Co., Bank of Montreal, Circle K (which is owned by Alimentation Couche-Tard Inc.), Brookfield Corp., Canadian Imperial Bank of Commerce, Bell and Telus Corp.

But Agnico Eagle Mines Ltd. is the fastest-growing Canadian brand as its value increased 115 per cent to $738.8 million.

Increases in brand value are visible across the board at Canadian mining companies and could continue in the next few years. Continued supply chain disruptions have contributed to this rise by commanding higher prices for gold and other minerals.

Brand Finance also determined the strength of brands, with A&W claiming the No. 1 spot. The fast-food restaurant chain received a brand strength index score of 87 out of 100, with a corresponding AAA rating, despite its brand value decreasing two per cent to $647.3 million.

A&W is still in its post-pandemic recovery stage, but the rating suggests it’s succeeding in building a strong level of brand equity and will return to brand value growth in the coming years.

Last year’s strongest brand, Canada Life, slid to spot two, followed by Intact Financial Corp., Scotiabank, Tim Hortons, Canadian Tire Corp. Ltd., TD, Shoppers Drug Mart Corp., Sun Life Financial Inc. and Maple Leaf Foods Inc.

On the other hand, Rogers Communications Inc. and Shaw Communications Inc. were among the companies that have taken a considerable hit to their brand value and strength as their controversial merger still awaits approval from federal regulators.

Canadian tech brands also took a hit, with Shopify Inc.’s brand value slumping 23 per cent to $1.1 billion. However, the tech slump is expected to stabilize in the near future.

Sustainability is another one of the attributes Brand Finance uses to assess the overall value of a brand. IT services firm CGI Inc. had the highest sustainability perceptions score — 5.89 out of 10 — with the company on track to achieve its net-zero target by 2030.

Other brands with high sustainability perception scores, in order, were Agnico Eagle, Nutrien Ltd., Hydro One Ltd., Canada Post, Toromont Industries Ltd., Suncor Energy Inc., Constellation Software Inc., Colliers International Group Inc. and Stantec Inc.

TD received the highest sustainability perception value (the value it has tied up in the sustainability perception of stakeholders) at $1.9 billion.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

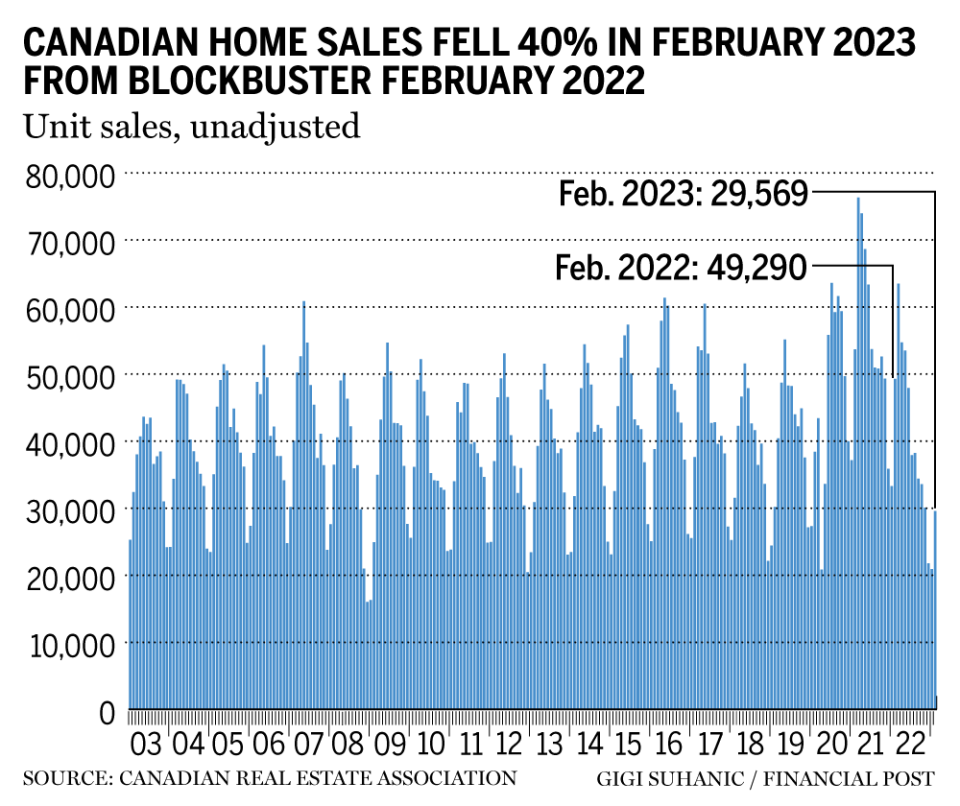

The spring housing market could be a reckoning for realtors in Canada. The big questions, the ones that will decide realtors’ fates, are whether buyers and sellers return in force and how that will affect prices. Figures released by CREA on March 15 show that actual (non-seasonally adjusted) transactions in February 2023 came in 40 per cent below a strong February 2022. New listings also continued to fall in February 2023, decreasing by 7.9 per cent month over month and hitting record lows in some cities. Read the full story by Shantaé Campbell for more details.

___________________________________________________

Today’s data: Canadians get the latest reading on monthly real GDP and Ottawa’s fiscal monitor. Also on the agenda are U.S. personal income and consumption, Chicago PMI and University of Michigan consumer sentiment index.

___________________________________________________

_______________________________________________________

‘No Ring of Fire without consent’: First Nations confront Doug Ford on mining claims at Queen’s Park

A Canadian godfather of AI calls for a ‘pause’ on the technology he helped create

The spring housing market could bring a reckoning for realtors in Canada

Budget’s changes to 3 registered savings plans could affect how you invest this year and beyond

____________________________________________________

Paying off a big debt is a great moment in someone’s life, but now what? How do you best use that newly available cash stream? Certified financial planner Janet Gray says it’s important to clarify the difference between saving, or protecting your money so it doesn’t decrease in value, and investing, which is for funding longer-term goals and future use. But you first need to figure out what you need the money for and when. Here’s how.

____________________________________________________

Today’s Posthaste was written by Noella Ovid, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Yahoo Finance

Yahoo Finance