'Unimpressive with a capital U': Slower growth a troubling sign for the Canadian economy

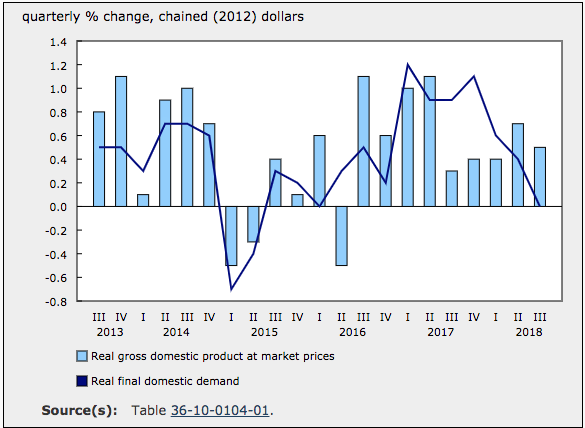

Canada’s economic growth cooled in the third quarter. Economists were expecting the pace to slow, but there were some scary surprises.

According to Statistics Canada, GDP grew at an annualized pace of 2 per cent. That’s down from 2.9 per cent in the previous quarter.

“The details were unimpressive with a capital U,” says Doug Porter, BMO’s chief economist.”

The most troubling detail among economist was business investment falling 7.1 per cent. Porter says the softness could be temporary.

“Let’s be charitable, and assume that some of that softness was due to uncertainty ahead of the USMCA deal (reached at the very end of Q3 and only signed this morning),” says Porter.

For the month, GDP fell 0.1 per cent. Weakness in mining and oil gas has Porter rethinking growth forecasts for growth in the fourth quarter.

“Suffice it to say that our prior call of 2.1% growth in Q4 is looking a tad suspect — we’re now zeroing in on something closer to 1.5% for this quarter.” says Porter.

Will the Bank of Canada keep hiking rates?

The Bank of Canada is expected to continue raising interest rates, but today’s economic report card could put a wrench in those plans.

“While the market continues to bravely assume the Bank of Canada will hike rates in early January, today’s details reinforce the message that it is still a close call, and may well require a marked improvement in oil prices to get there.” says Porter.

Avery Shenfeld, CIBC’s chief economist, says Canada needs to do better.

“The Bank of Canada was hoping that business capital spending would emerge as a

replacement for housing as a growth driver, and in Q3 it went the other way, as companies

reduced equipment and structures,” says Shenfeld.

Shenfeld also sees a poor handoff into the fourth quarter, and fewer rate hikes than the market is expecting.

“These aren’t the sort of numbers that back a rate hike in December, and we’ll need to see much better results for October, and at least a hint of good news on oil, to support our call for a January hike,” says Shenfeld. “Risks are growing towards pushing that next hike further into 2019.”

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance