Bank of Canada rate cut watchers starting to look past the summer

2024 kicked off with the economy flexing more muscle than anticipated. That has the rate market spooked, as it constantly looks for signs of an inflation comeback tour.

For bond yields, which tend to lead fixed mortgage rates, it has been a see-saw. Today, for example, yields shot up on firmer U.S. economic data. No one’s sounding the alarm for a fixed-rate spike just yet, but keep an eye on the mortgage market’s northern star, Canada’s five-year yield. It must stay below 3.85 per cent or so, or fixed rates could leap.

Looking further out, the market has pushed the first Bank of Canada interest rate cut to July-ish, according to the forward rate data provided by CanDeal DNA. There’s lots of noise in such outlooks, but suffice it to say, we’re still likely several months away from significant rate relief.

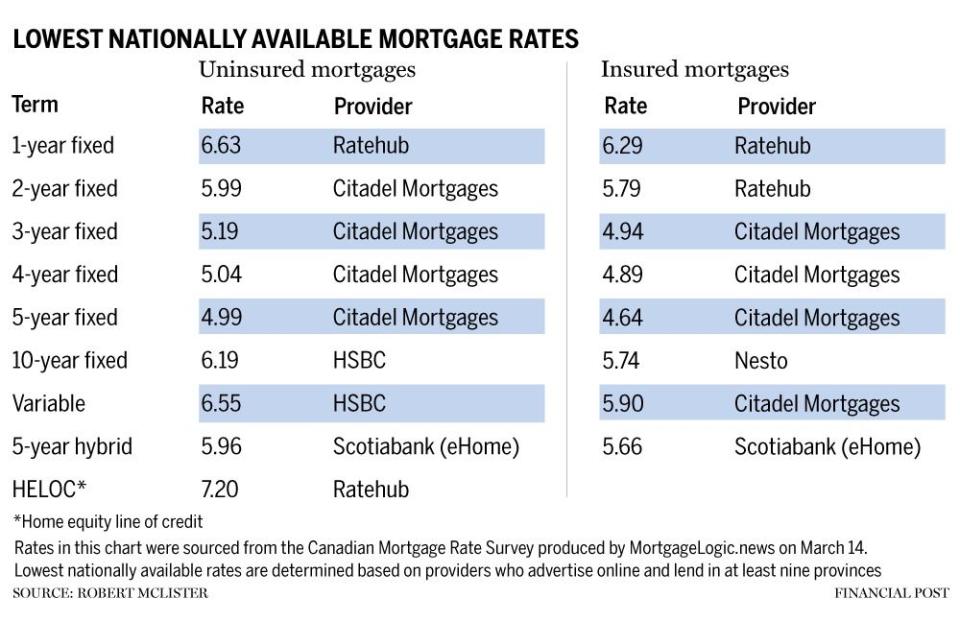

Meanwhile, in the world of “no news is good news,” the lowest nationally available fixed and variable rates didn’t budge an inch this week. Don’t expect significant movement until we get the inflation improvement economists expect this spring, or an unpleasant surprise. Cross your fingers for the former.

Robert McLister is a mortgage strategist, interest rate analyst and editor of MortgageLogic.news. You can follow him on X at @RobMcLister.

Click here for the lowest national mortgage rates in Canada right now

Yahoo Finance

Yahoo Finance