Battery plants or bust: Why some think Ottawa's $30-billion EV bet puts Canada on the wrong track

Canada is pouring billions of taxpayer dollars into electric vehicle battery plants, but is this the best way for policymakers to grab a piece of the EV supply chain?

It’s a question some industry watchers are asking now that the federal government has committed $13 billion toward a Volkswagen AG battery plant in St. Thomas, Ont., as well as $15 billion in funding for the construction of a Stellantis NV-LG Energy Solution battery plant in Windsor, Ont.

While batteries are a key component of the EV market, Greig Mordue, a professor of engineering at McMaster University in Hamilton, Ont., and former general manager of Toyota Motor Manufacturing Canada, thinks the incentives were “over-the-top,” and ultimately won’t give Canada the edge over the United States it is looking for.

“I don’t understand, frankly, the fixation on a battery plant,” Mordue said. “They wanted a battery plant. Nothing else would suffice.”

Mordue believes Canada should focus on EV assembly plants, which come with a lot of spin-off benefits, such as the manufacturing of car seats and stamp parts. Such large, bulky car parts would have to be manufactured in Canada, near the assembly plant, because it would be too expensive to transport them over long distances.

They wanted a battery plant. Nothing else would suffice

Greig Mordue

“You compare an assembly plant in Canada with one in the U.S., typically we’re just as good,” he said. “Absolutely we are competitive in final assembly.”

But attracting an assembly plant isn’t cheap either, Mordue said. In recent years, the cost of attracting such a plant has hovered in the $1-billion range, but still, he noted, that’s only “1/15th of what we paid for a single battery plant.”

Mordue’s criticism comes as the fight for turf in the emerging EV industry heats up, led by aggressive U.S. subsidies.

The introduction of the U.S. Inflation Reduction Act in August 2022, which features hundreds of billions of dollars of new spending and tax breaks to encourage clean energy industries in the U.S., has “vastly accelerated the clean energy arms race,” said Michael Bernstein, executive director of Clean Prosperity, a Toronto-based think tank that researches Canadian climate policy.

Countries around the world, including Canada, are all vying to become the go-to destination for one or more pieces of green energy supply chains, such as EV battery manufacturing.

“Canada does have a number of fairly generous investment tax credits … and those would be fantastic, and to be fully applauded in an environment where there was no Inflation Reduction Act,” Bernstein said. But the Inflation Reduction Act is a “game changer,” he said, and if Canada wants a piece of the green energy pie, it will need to prioritize sectors where we can compete and win.

In response to the IRA, Canada’s most recent budget includes $60 billion of clean energy tax credits and $20 billion in sustainable infrastructure investments. It also reaffirms the government’s commitment to EV battery manufacturing. Canada has the “potential to be a global leader in battery manufacturing,” the budget reads.

Mordue doesn’t buy it. When it comes to battery manufacturing, the U.S. is always going to come out on top, he said.

That’s because the U.S. has an edge that Canada does not: the headquarters of major automakers, including Ford Motor Co., General Motors Co., and Stellantis North America, formerly known as Chrysler.

When it comes to securing contracts related to automaking, having the headquarters of a major companies on your territory is “everything,” Mordue said. “In the automotive industry, all of the high-order, high value-added, most knowledge-intensive work, gravitates … to the headquarters of the major automakers.”

So, while Canada can spend billions of dollars and get a battery plant, chances are Canada will secure only a small portion of the most important parts of the automotive value chain, he said. Functions like R&D, design, marketing and finance will remain in the U.S., Germany, Japan, or Korea, which host the headquarters of the major automakers.

Mordue doesn’t expect Canada to host the headquarters of a major automaker anytime soon. But, he points out, its investments in battery plants are of such a scale that they could have enabled it to buy a sizeable stake in Stellantis or another automaker.

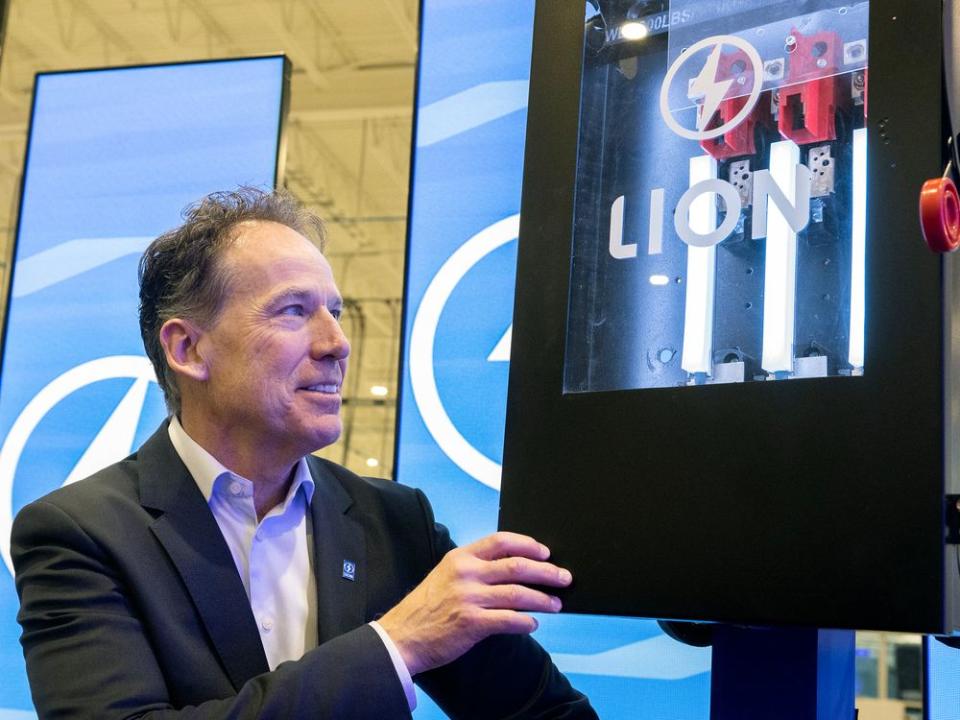

Marc Bédard, chief executive of The Lion Electric Co., an electric truck and school bus manufacturer headquartered in Quebec, says the EV manufacturing incentives on the Canadian side are nevertheless a “good start.”

Canada has, for example, a 30 per cent tax credit toward the manufacturing of clean technologies. But he too acknowledges the appeal of the U.S. subsidies.

“To be honest, I think the IRA is more aggressive than what we have right now on the Canadian side,” Bédard said.

At the end of July, Lion opened an electric school bus and truck manufacturing plant in Joliet, Ill. Through the IRA, businesses that purchase Lion vehicles might qualify for a tax credit of up to US$40,000, spokesperson Marie-Eve Labranche wrote in an email.

Lion does its manufacturing in both countries. In addition to the factory in Joliet, the company has two plants in Canada: one in St. Jérôme, Qué., which assembles their EVs, and another in Mirabel, Qué, that manufactures EV batteries.

For Lion, the question of where to build the plant has less to do with subsidies, and more to do with being close to the target market and to their suppliers, said Bédard. They want all of their Canadian sales to come from their Canadian plants, and all their U.S. sales to come from the U.S. plants, so that an individual working in a Lion plant will see the school buses they helped build driving through their own communities.

“The people are seeing the final result of what they are doing,” said Bédard. “It’s not just a metal bracket — it’s a metal bracket that you’re using on a school bus on which you are putting your own kids.”

He acknowledges that the U.S. incentives are more attractive than the Canadian ones at this point. The main issue with the Canadian tax credits — such as the Clean Technology Manufacturing Investment Tax Credit — are that they’ll only be available next year, he said.

“We’re making a lot of investments right now. And we know that time matters, and speed matters,” Bédard said. “Some of those tax credits will be available only next year…. It’s going to be good money, it’s going to be a good incentive as well, but obviously, the earlier the better.”

While it would be too expensive for Canada to copy the U.S. approach in its entirety, it should certainly try to replicate some elements, Bernstein said. For example, the U.S. is doing a good job of identifying sectors where it can compete and identifying what exactly they need to do to maximize competitiveness.

Canada should try to emulate the American Liftoff Reports, Bernstein said. These are detailed documents that lay out clear economic objectives toward clean energy goals. Using a “sector by sector” approach, each report identifies a goal, what is required to achieve it, barriers to achieving it and government policies that could be used to help accomplish it, which enables the government to “work closely with industry to get it done,” Bernstein said.

By comparison, the equivalent Canadian documents are “very general,” Bernstein said. For example, ‘The Hydrogen Strategy for Canada’ says, “‘here are all the places in Canada where we could produce hydrogen, here are all the different kinds of hydrogen, and here are all the different things that could be opportunities for Canada.’” But unlike the equivalent U.S. Liftoff report, it’s not really a road map.

The U.S. incentives are also easier to understand than the Canadian ones.

“In the U.S., you can look to the rules in the IRA, and you can know, with confidence, this is how much money per unit of output that we are going to receive … you can have confidence in that number,” Bernstein said. “In Canada, it’s just completely unclear.”

Stellantis and Volkswagen had to endure a long negotiation process in order to figure out what subsidies they would receive, because it “wasn’t clear at the outset what they were going to get,” he said.

Dennis Darby, chief executive of Canadian Manufacturers and Exporters, agrees.

“Because of the easy support that they get in the slightly more … complex rules in Canada, there is a risk that companies will take the path of least resistance,” he said.

The U.S. is running a different race than Canada, so Canada shouldn’t bankrupt itself trying to catch up, Bernstein said.

First off, the U.S. might be in fact be “overspending” with the IRA, as some estimates put the total cost of the bill at a trillion dollars. Second, as much as the IRA is about clean energy, it’s also about geopolitics — competing with China and national security, he said.

“We’re not going to be able to compete in all of the areas in the U.S. — it’s just going to be too expensive — but what are some areas in which Canada has some unique advantages, and how are we going to capitalize on those opportunities with specific policies?’”

Those advantages should be the focus of Canada’s “modern industrial strategy,” he said.

Future of Canada’s mining industry hangs on who gets U.S. subsidies

How energy transition push is changing mining’s rush for gold

Whether battery plants alone will be worth the investment remains to be seen.

Correction: A previous version of this article stated that Lion would receive the tax credit when it is in fact businesses that purchase Lion vehicles that will receive the tax credit.

• Email: mcoulton@postmedia.com | Twitter: marisacoulton

Yahoo Finance

Yahoo Finance